This course teaches you how to protect your retirement money during market dips, so you can stay on track.

A downturn doesn’t have to take your retirement off course.

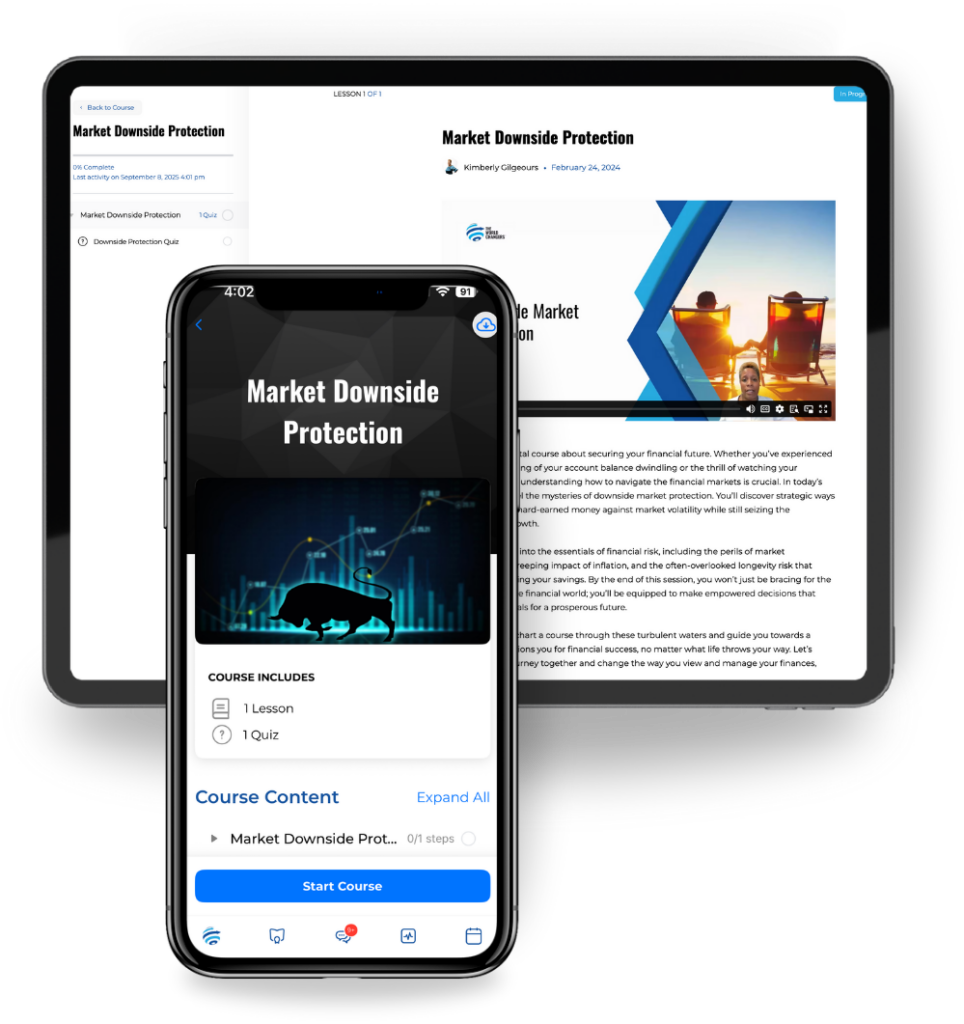

The Market Downside Protection course shows you how to protect what you’ve worked for—without having your money sit on the sidelines.

Learn how to keep your retirement on track—even when the market isn’t.

Every time the market goes down, I get worried.

Is it safer to just keep my money in the bank?

Will my retirement money last as long as I live?

I don’t want to have to work ten extra years because my 401(k) went down.

I want growth—but I can’t afford a 30% dip again.

…this is where the confusion ends, and it all starts to make sense.

Market swings can feel overwhelming when you don’t know what to do.

This course is clear and easy to follow, with a short quiz at the end to make sure it sticks.

Understanding Risk

Ways to Manage Risk

Worrying about market losses often pushes you into one of three traps: avoiding risk altogether, hoping the market rebounds, or trying to manage it yourself. The problem is none of those give you real protection—uncover what can.

Risk Transfer Explained

Carrying all the risk yourself leaves your future exposed. You might believe the market alone will protect you, but it may not. Here, you’ll see what risk transfer really is, how it works, and why shifting the burden off your shoulders gives you more than just peace of mind.

Downside Protection + Growth

You’ve been told that protecting your money means sacrificing growth. That trade-off leaves you either exposed to losses or stuck earning too little. Downside protection shows how you can create lifetime income, lock in gains, and still grow your savings.

“For the first time, I feel confident my retirement can handle market ups and downs.”

It’s easy to feel confident when the market is going up. But one downturn can unravel years of saving and leave you second-guessing every decision.

This course makes sure that doesn’t happen. It shows you how to protect what you’ve built, keep your plan steady, and stop worrying every time the market dips.

When your savings are protected, your future feels secure.

One Membership.

50+ Courses.

From basic to advanced—for every stage.

The World Changers Network was built for real families who want guidance they can trust. We make financial education simple and practical, with courses, experts, and tools that meet you where you are.

Change your finances. Change your world.

Before I found The World Changers Network, I didn’t have any real financial knowledge. I was just spending money—no budget, no savings, four credit cards maxed out.

Since joining the Network, I’ve paid off one credit card, started budgeting with my wife, and even got life insurance in place. I think about my spending totally differently now.

Nick N.

Sales Development Representative

Talking about finances is never easy, but TWC made the whole experience feel comfortable, clear, and empowering.

Every part of the process was explained and helped me understand what I needed to do and improve. I highly recommend — 100%!

To anyone reading this: take the step and start working on your finances. It’s truly worth it for your future and your peace of mind.

Marosky G.

Software Engineer

It forced us to have conversations about money, together. Before we felt like we weren’t on the same page in making financial decisions together.

Coming on to this platform as a partnership, has allowed us to build an understanding, know where we are going and make intentional financial decisions together. And that is so important!

Tamella & Raymond T.

Principal / Minister

At 68, I’m about to become a first-time homebuyer, thanks to The World Changers.

TWC gave me peace of mind and financial freedom, proving it’s never too late to build wealth and achieve homeownership.

Highly recommended for those looking to secure their future!

Elsiana J.

Executive Assistant

I’m excited about the courses to learn how to manage my money. From the first contact to the closing, the attention was impeccable, professional, and friendly.

They focus not only on what they do, but on how they do it: with ethics, commitment, and a genuine desire to help. Highly recommended for those seeking quality, compassion, and real results!

Jomar S.

Professional Wrestler

Pick the plan that fits you best and start Money Matters today.

Get the essentials: core courses, on-demand learning, and a community that helps you move forward.

Save $269 a year and unlock it all—live Q&A with financial pros, member rewards, and tools built to keep your plan on track.