Rollover

Without Risk

Learn how to roll over your 401(k) the right way—and keep your retirement money protected from market dips, penalties, and avoidable mistakes.

If you've ever thought…

Every time the market goes down, I get worried.

Is it safer to just keep my money in the bank?

Will my retirement money last as long as I live?

I don’t want to have to work ten extra years because my 401(k) went down.

I want growth—but I can’t afford a 30% dip again.

…this is where the confusion ends, and it all starts to make sense.

Rolling over a 401(k) is a chance to keep your retirement on track—even when the market isn’t.

This course shows you how to make smart rollover decisions that avoid costly penalties and protect your savings from market downturns—while still benefiting from market growth.

By the end, you’ll know how to protect your future income, avoid unnecessary losses, and stop stressing every time the market dips.

What you’ll learn

Get the steps to protect your savings from market downturns—and feel secure knowing your money can still grow for the future.

You’ll learn how to:

- Rollover your 401(k) or retirement plan to an IRA

- Understand market, inflation, and longevity risks—and the real cost of ignoring them

- Compare the three most common ways people try to manage market risk (and why they often fall short)

- Learn what risk transfer actually is—and how it guarantees protection

- See how annuities can provide lifetime income, upside potential, and zero market losses

- Learn the key questions to ask to know if this protection fits into your bigger financial picture

- Know what to look for in protection products—so you don’t choose the wrong one

If you wonder how to keep your lifestyle in retirement…

If you feel stuck between risk and no growth…

If no one has explained downside protection clearly…

This is for you.

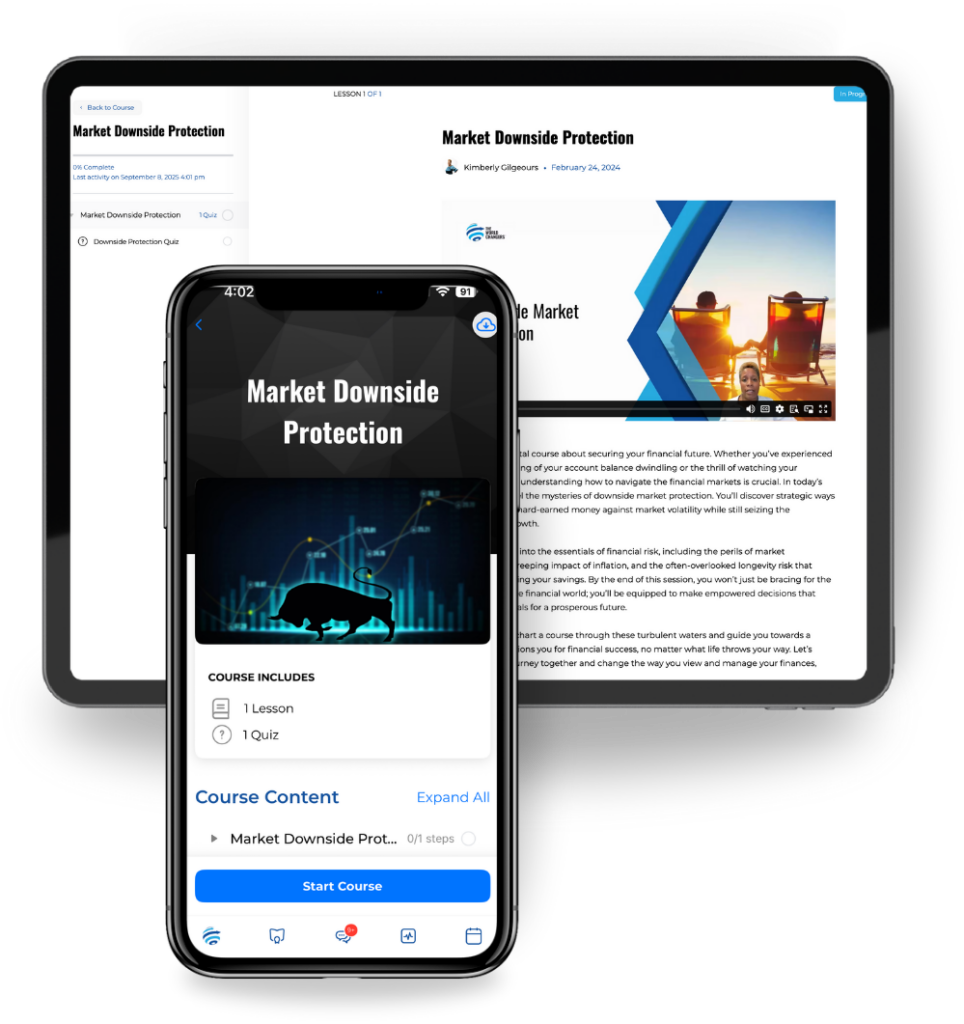

Inside the course

Market swings can feel overwhelming when you don’t know what to do.

This course is clear and easy to follow, with a short quiz at the end to make sure it sticks.

Understanding Risk

Ways to Manage Risk

Worrying about market losses often pushes you into one of three traps: avoiding risk altogether, hoping the market rebounds, or trying to manage it yourself. The problem is none of those give you real protection—uncover what can.

Risk Transfer Explained

Carrying all the risk yourself leaves your future exposed. You might believe the market alone will protect you, but it may not. Here, you’ll see what risk transfer really is, how it works, and why shifting the burden off your shoulders gives you more than just peace of mind.

Downside Protection + Growth

You’ve been told that protecting your money means sacrificing growth. That trade-off leaves you either exposed to losses or stuck earning too little. Downside protection shows how you can create lifetime income, lock in gains, and still grow your savings.

“For the first time, I feel confident my retirement can handle market ups and downs.”

Why this course matters

It’s easy to feel confident when the market is going up. But one downturn can unravel years of saving and leave you second-guessing every decision.

This course makes sure that doesn’t happen. It shows you how to protect what you’ve built, keep your plan steady, and stop worrying every time the market dips.

When your savings are protected, your future feels secure.

This course is just the beginning.

Your membership unlocks more courses, expert Q&A, and tools to build your plan.

One Membership.

50+ Courses.

From basic to advanced—for every stage.

Who we are

The World Changers Network was built for real families who want guidance they can trust. We make financial education simple and practical, with courses, experts, and tools that meet you where you are.

Change your finances. Change your world.

What our members say

Before I found The World Changers Network, I didn’t have any real financial knowledge. I was just spending money—no budget, no savings, four credit cards maxed out.

Since joining the Network, I’ve paid off one credit card, started budgeting with my wife, and even got life insurance in place. I think about my spending totally differently now.

Nick N.

Sales Development Representative

Talking about finances is never easy, but TWC made the whole experience feel comfortable, clear, and empowering.

Every part of the process was explained and helped me understand what I needed to do and improve. I highly recommend — 100%!

To anyone reading this: take the step and start working on your finances. It’s truly worth it for your future and your peace of mind.

Marosky G.

Software Engineer

It forced us to have conversations about money, together. Before we felt like we weren’t on the same page in making financial decisions together.

Coming on to this platform as a partnership, has allowed us to build an understanding, know where we are going and make intentional financial decisions together. And that is so important!

Tamella & Raymond T.

Principal / Minister

At 68, I’m about to become a first-time homebuyer, thanks to The World Changers.

TWC gave me peace of mind and financial freedom, proving it’s never too late to build wealth and achieve homeownership.

Highly recommended for those looking to secure their future!

Elsiana J.

Executive Assistant

I’m excited about the courses to learn how to manage my money. From the first contact to the closing, the attention was impeccable, professional, and friendly.

They focus not only on what they do, but on how they do it: with ethics, commitment, and a genuine desire to help. Highly recommended for those seeking quality, compassion, and real results!

Jomar S.

Professional Wrestler

Choose your membership

Pick the plan that fits you best and start Money Matters today.

Included in Every Plan

- Full access to all beginner + advanced courses

- Ask financial pros your questions—anytime, inside our private Network

- Step-by-step Personal Financial Strategy designed by a Financial Pro ($1,500 value)

- Create your Will ($350 value)

- Monthly Wealth Building Live Events

- Private member community—connect with financial experts

- Invitation-only access to the X Change Conference

- With each new member and every financial milestone reached, we fund meals, water, and education worldwide.

Flex

$39.00 / Month

Month to month—cancel anytime.

- All Basic Features

Get the essentials: core courses, on-demand learning, and a community that helps you move forward.

Premium

$199.00 / Year

- Everything in Flex+

- Save $269/year with annual membership

- Affiliate Program—earn by sharing

- Bonus: Financial Pro Pre-License Certification Course

Save $269 a year and unlock it all—live Q&A with financial pros, member rewards, and tools built to keep your plan on track.